The 10-Minute Rule for Neutralizing Pet Odors

Wiki Article

Unknown Facts About Neutralizing Pet Odors

Table of ContentsThe Basic Principles Of Neutralizing Pet Odors A Biased View of Neutralizing Pet OdorsNot known Facts About Neutralizing Pet OdorsGetting My Neutralizing Pet Odors To Work

Have you ever wondered what the distinction was between a residence guarantee and residence insurance coverage? Both safeguard a residence as well as a property owner's pocketbook from expensive fixings, yet what specifically do they cover? Do you require both a house warranty as well as home insurance, or can you get simply one? Every one of these are exceptional concerns that many home owners ask.

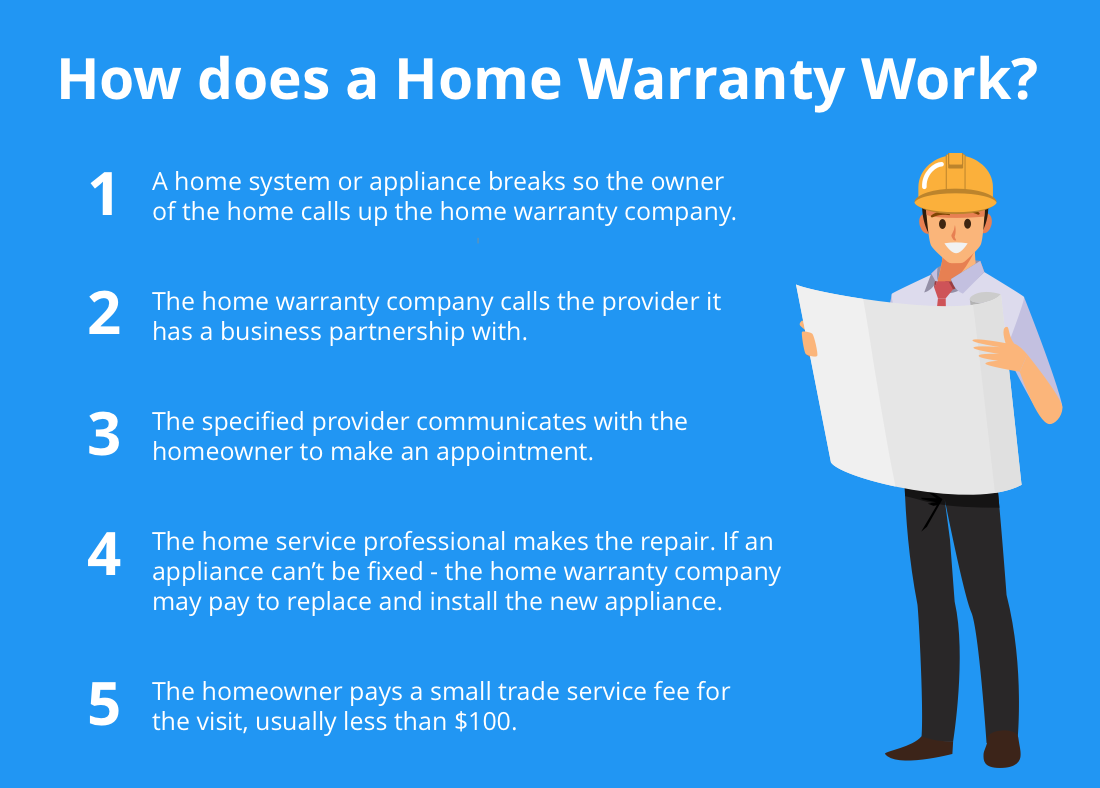

What is a home warranty? A house guarantee secures a residence's inner systems and also devices. While a home service warranty agreement is comparable to residence insurance policy, particularly in how a home owner utilizes it, they are not the exact same point. A property owner will certainly pay an annual costs to their house warranty firm, normally in between $300-$600.

If the system or appliance is covered under the house owner's house guarantee plan, the house guarantee business will certainly send a service provider that specializes in the fixing of that particular system or device - neutralizing pet odors. The home owner pays a level price solution call charge (normally between $60-$100, relying on the house guarantee business) to have the service provider pertained to their residence as well as identify the problem.

The 3-Minute Rule for Neutralizing Pet Odors

What does a residence warranty cover? A house service warranty might also cover the bigger home appliances in a residence like the dishwasher, stove, fridge, clothes washer, and also clothes dryer.If a commode was leaking, the house guarantee company would pay to fix the toilet, but would not pay to repair any water damages that was created to the framework of the house because of the dripping toilet. If a homeowner has a home loan on their home (which most property owners do) they will be needed by their home mortgage loan provider to purchase home insurance.

House insurance may also cover clinical costs for injuries that people received by being on your property. When something is damaged by a calamity that is covered under the residence insurance coverage policy, a property owner will certainly call their home insurance policy firm to file a claim.

Neutralizing Pet Odors for Dummies

What is the Distinction In Between House Service Warranty and House Insurance A house service warranty agreement and also a home insurance policy run in comparable means. Both have a yearly premium and also a deductible, although a home insurance premium and insurance deductible is frequently much greater than a house guarantee's. The major distinctions in between residence warranties and house insurance policy are what they cover.One more difference in between a house service warranty as well as house insurance policy more info here is that residence insurance policy go to this website is usually needed for home owners (if they have a home mortgage on their house) while a residence service warranty plan is not required - neutralizing pet odors. A residence service warranty as well as residence insurance policy give security on various components of a home, as well as with each other they can safeguard a home owner's budget from expensive repair services when they inevitably appear.

If there is damages done to the framework of your house, the owner will not need to pay the high costs to fix it if they have residence insurance coverage. If the damage to the home's framework or house owner's belongings was brought about by a malfunctioning appliances or systems, a home service warranty can assist to cover the costly fixings or substitute if the system or home appliance has stopped working from typical wear and tear.

5 Simple Techniques For Neutralizing Pet Odors

"However, the a lot more systems you add, such as swimming pool insurance coverage or an extra heating unit, the greater the price," she states. Adds Meenan: "Prices are typically flexible as well." Other than the annual charge, homeowners can anticipate to pay usually $100 to $200 per solution call check out, relying on the kind of agreement you buy, Zwicker notes.House warranties do not cover "items like pre-existing conditions, pet infestations, or recalled items, clarifies Larson."If people don't review or understand the coverages, they may end up thinking they have protection for something they don't.

"We paid $500 to sign up, and then needed to pay another $300 to clean up the major sewer line after a shower drain backup," says the Sanchezes. With $800 out of pocket, they thought: "We didn't gain from the home guarantee in any way." As a young couple in one more home, the Sanchezes had a tough experience with a residence service warranty.

When the specialist wasn't satisfied with a reading he obtained while testing the furnace, they say, the firm would not consent to protection unless they paid to replace a $400 component, which they did. While this was the Sanchezes experience years ago, Brown verified that "examining every major appliance before offering protection is not an industry requirement."Always ask your carrier for clarity.

Report this wiki page